Order Management

System

“Quality is not an act, it is a habit.”

Aristotle

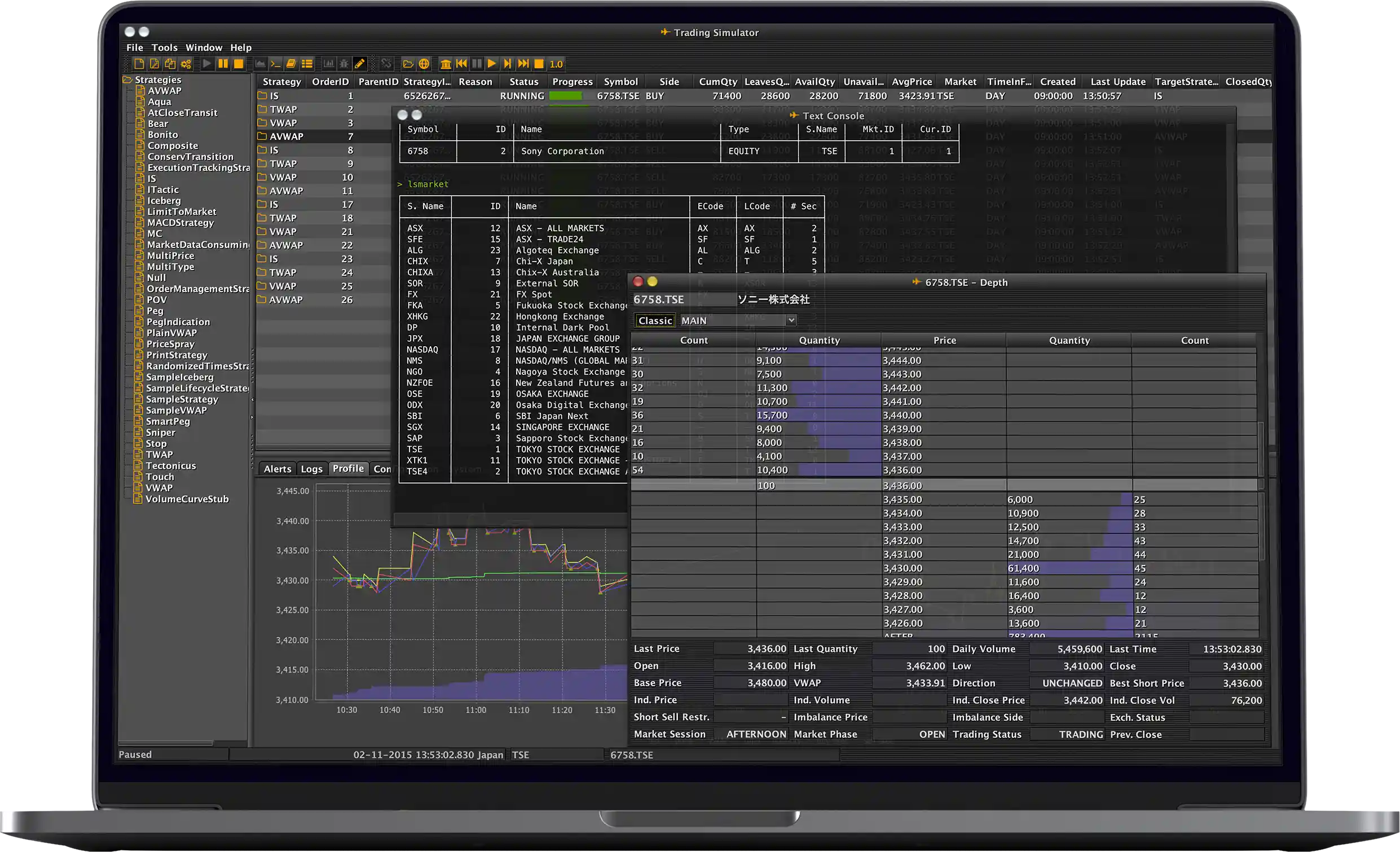

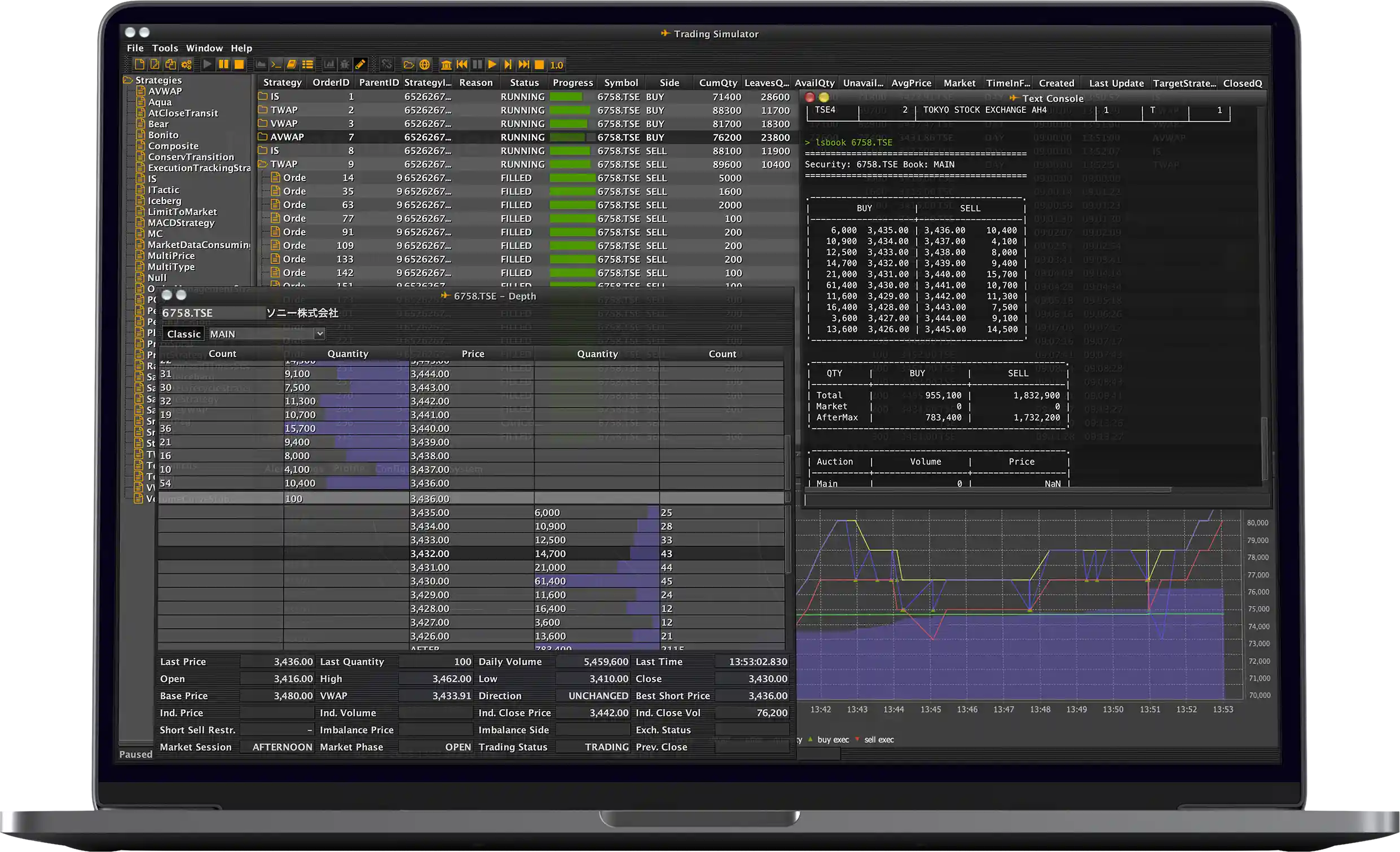

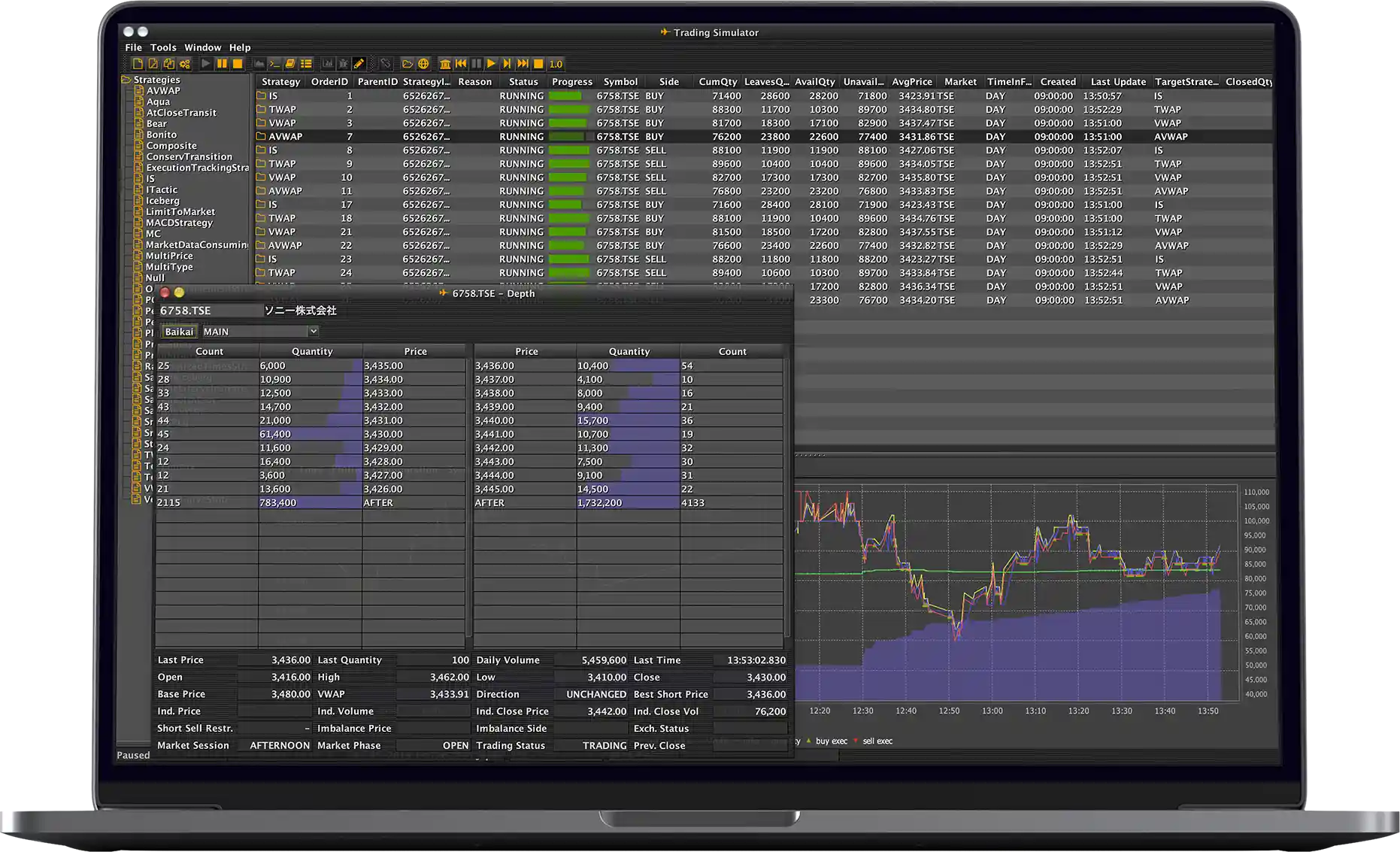

The OMS is the centrepiece of the electronic workflow. It connects the users to various internal and external markets, providing access to the smart routing, algorithmic trading, crossing, cross negotiation and other capabilities common to modern trading platforms. The OMS holds the knowledge of client, care, market-side and custom orders and provides a holistic picture of the current state of the execution flow it is deployed to manage.

Less than

9µs

for

99.5%

of messages

(including the network hops) for

the “business” IPC layer.

Latency

Engineered for High-Performance Trading

Meet an OMS that’s built different — modular, resilient, and blazing fast. Our micro-kernel architecture and event-driven core deliver real-time performance and always-on reliability.

Atomic Components

Each module does one thing — and does it flawlessly. Failures are isolated and recover instantly with redundant peers.

Event-Driven Core

Every meaningful event is captured, stored, and reacted to — powering transparent, audit-ready workflows.

Messaging That Never Misses

Gapless, ordered, real-time messaging with built-in persistence. Late joiners? No problem.

Architectural Principles

Functional Overview