Advanced

Trading

Solutions

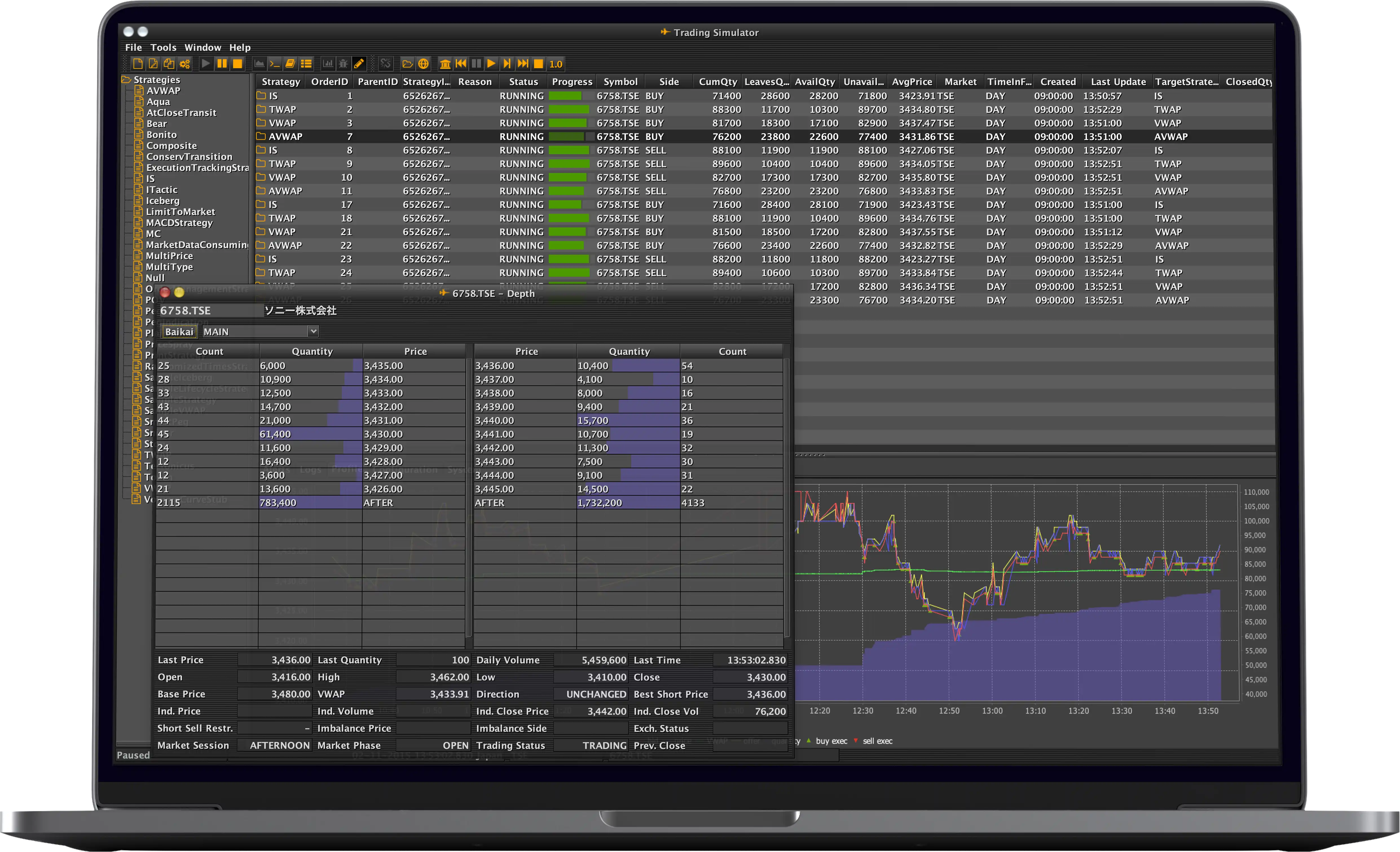

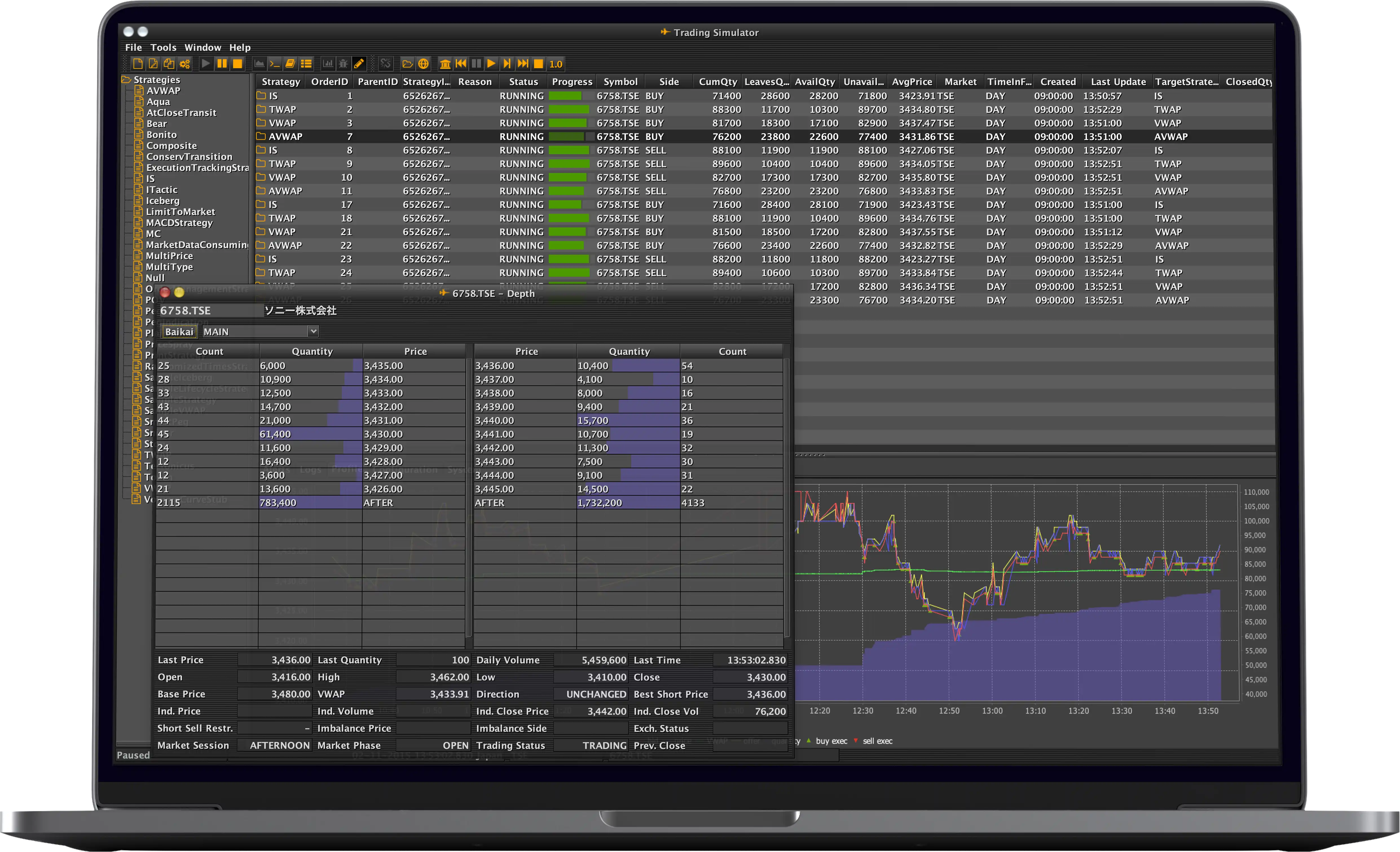

Develop, test, and optimize your strategies

effortlessly.

Analyse market trends and execute trades with precision using

Algoteq’s advanced tools.

effortlessly.

Analyse market trends and execute trades with precision using

Algoteq’s advanced tools.

What We Offer

A fully integrated, high-performance trading ecosystem designed for reliability, speed, and innovation: