Algorithmic

Platform

possible, but not simpler. ” Albert Einstein

Trading strategies, or algorithms, constitute the brain of the electronic trading framework. They provide the clients, be they internal trading desks or external financial institutions, an intelligent fully automated facility to achieve their trading objectives with sufficient degree of control and transparency. The Algorithmic Container provides the required infrastructure to incrementally design, implement, test and deploy the strategies to meet the needs of the most sophisticated and demanding customers.

Architectural Principles

Buy & Sell Side

The Algorithmic Container supports both agency and proprietary trading. While their setups differ, the same execution and alpha-seeking algorithms can be used to reduce slippage and improve performance, within regulatory limits.

Multi-Asset Trading

Our solutions are geared towards multi-asset trading that becomes

crucial in the investment banking brokerage industries to achieve

uniformity, improve efficiency, risk transparency and promote

cross-selling on various levels.

Even if the initial client requirements are skewed towards a

particular business flow and asset type, design provisions were put in

place to make the components extendible to multi-asset trading.

Composite Strategies

We avoid monolithic approach in strategy development and encourage the use of the Composite pattern by nesting strategies. This can be done both statically in the code and the configuration.

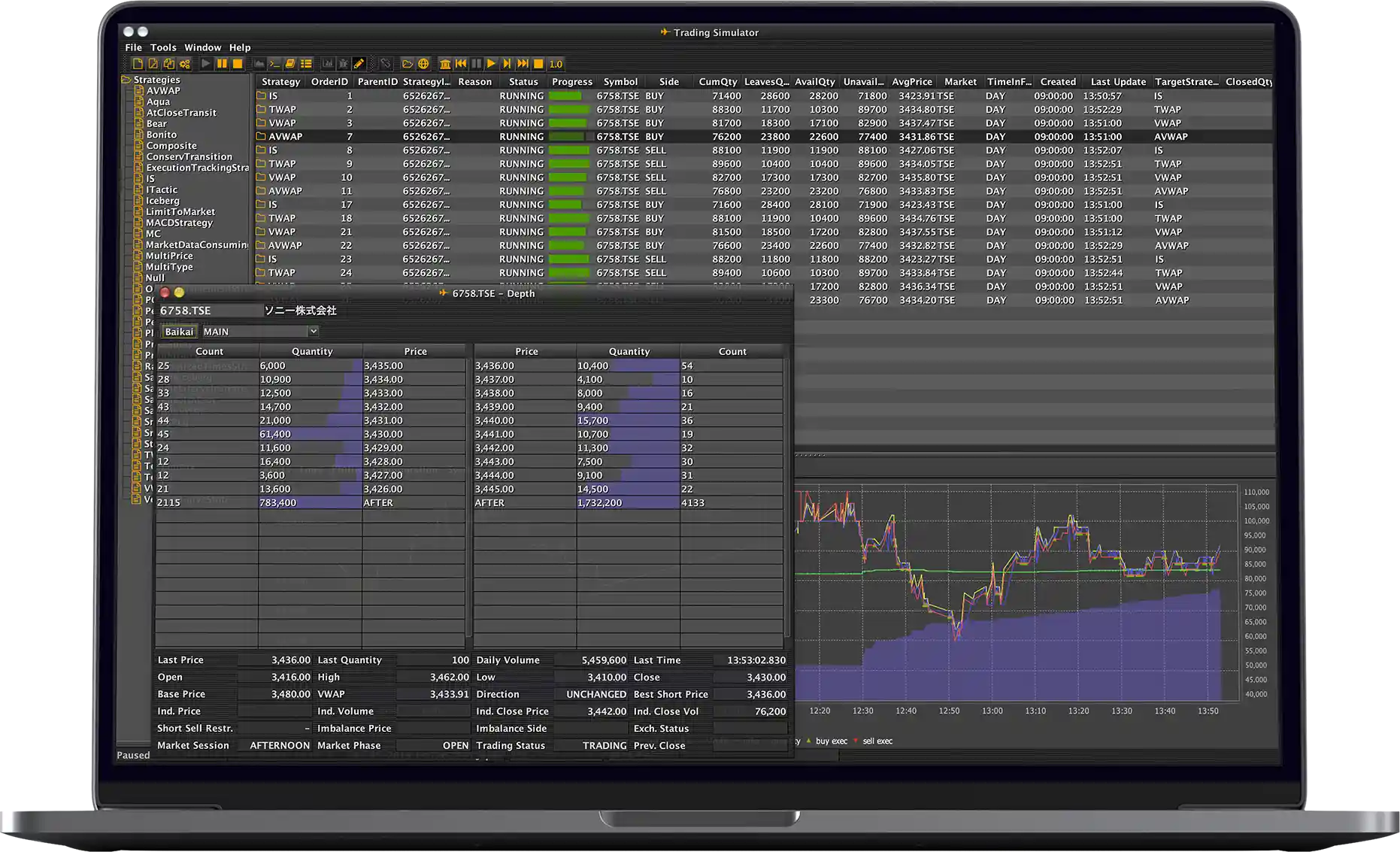

Trading Simulator

As a test harness for prototyping quantitative ideas and a “debugger” for troubleshooting, refining and testing strategies, we incorporate the Trading Simulator. The simulator is an intrinsic part of the platform and can be an invaluable tool for: